child tax credit portal not working

And towards the end of this post we will walk through step-by-step what you need in order to. Making a new claim for Child Tax Credit.

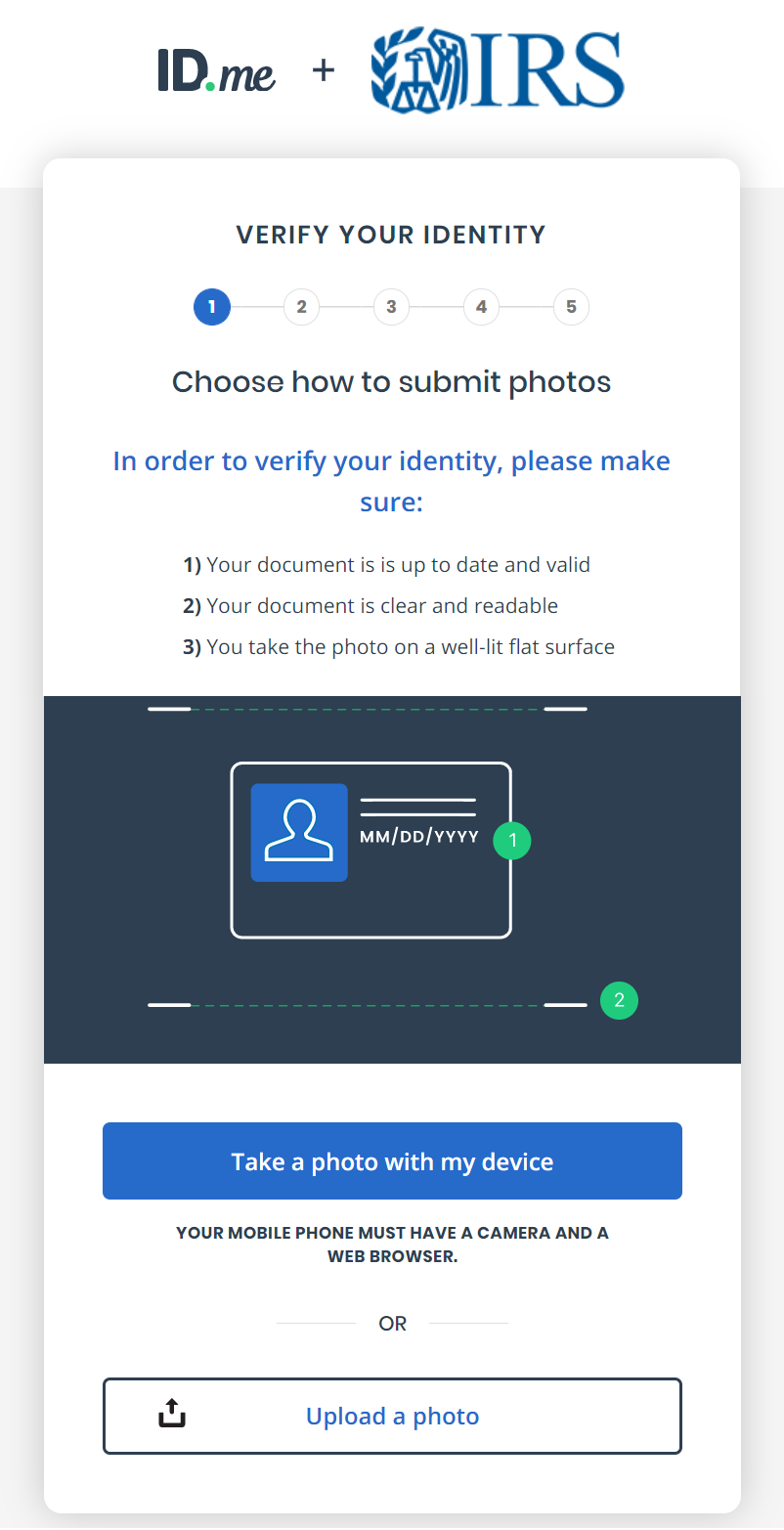

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Enter your information on Schedule 8812 Form.

. Updated on 72121. From here you can see if you are eligible for the child tax credit and check on whether you are currently enrolled to receive money or not. 1 in 10 Eligible Families Did Not Receive Child Tax Credit Payments.

Connecticut State Department of Revenue Services. Making a new claim for Child Tax Credit. Department of Revenue Services.

If you were eligible to receive advance Child Tax Credit payments based on your 2020 tax return or 2019 tax return including information you entered into the Non-Filer tool for Economic Impact Payments on IRSgov in 2020 or the Child Tax Credit Non-filer Sign-up Tool in 2021 you generally received those payments automatically. Sales tax relief for sellers of meals. These people can now use the online tool to register for monthly child tax credit payments.

I cant even get into the portal it keeps saying unavailable and doesnt have my name just TAXPAYER and the little cloud crying. Child Tax Credit portal not working. The IRSs child tax credit portal looks like crap and its not really usable for low-income Americans trying to get 300 monthly federal.

The IRSs child tax credit portal looks like crap and its not really usable for low-income Americans trying to get 300 monthly federal payments. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The IRS will pay 3600 per child to parents of young children up to age five.

If you are not you can either still file taxes or use the Non. To reconcile advance payments on your 2021 return. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. Half of the money will come as six monthly payments and half as a. Have been a US.

I cant even get into the. Once you reach the homepage you will scroll down and click on Manage Advance Payments. Get your advance payments total and number of qualifying children in your online account.

Sales Tax Holiday - To learn more about this years Sales Tax Free Week click here. In other words a lengthy process where you have to request a custom document be provided. 4 via the IRS Child Tax Credit Update Portal.

- Click here for updated information. You can unenroll by contacting the IRS at the phone number on your Advance Child. June 28 2021 The Child Tax Credit Update Portal allows you to verify your eligibility for the payments.

You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. This year Americans were only required to file taxes if they. The amount you can get depends on how many children youve got and whether youre.

Its called the Non-filer sign-up tool which is for people who did NOT we repeat DID NOT file their 2020 taxes which would have been done in 2021. To be eligible for this rebate you must meet all of the following requirements. Gas Tax - For updated information on the Suspension of the Motor Fuels Tax click here.

The Child Tax Credit Update Portal allows you to verify your familys eligibility for advance payments of this tax credit and add or update a bank account to receive your payments quickly by direct deposit. The advance is 50 of your child tax credit with the rest claimed on next years return. You must have claimed at least one child as a dependent on your 2021 federal income tax return who was 18 years of age.

You can also use the tool to unenroll from receiving the monthly payments if you prefer to receive a lump sum when you file your tax return next year. The IRS has opened an online site to enable taxpayers to unenroll from receiving advance payments of the 2021 child tax credit CTC. The new Child Tax Credit Update Portal allows parents to view their eligibility view their expected CTC advance payments and if they wish to do so unenroll from receiving advance payments ie to opt out.

You can also use the portal to unenroll from receiving the monthly payments if you are not eligible or prefer to receive the full. The amount you can get depends on how many children youve got and whether youre. You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children.

2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. You can access the CTC Update Portal here. Not everyone is required to file taxes.

Child Tax Credit portal not working. Ad The new advance Child Tax Credit is based on your previously filed tax return. These people can now use the online tool to register for monthly child tax credit payments.

However if you simply need to opt out of payments you can do so through Nov. You may be eligible for Child Tax Credit payments even if you have not filed taxes recently. You must be a resident of Connecticut.

Posted by 2 months ago. The IRS is still dealing with a backlog of tax returns and it is possible a delay in processing your tax return has caused a delay in processing your eligibility for the child tax credit. Already claiming Child Tax Credit.

The Child Tax Credit Update Portal is no longer available.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Childctc The Child Tax Credit The White House

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Didn T Get Your Child Tax Credit Here S How To Track It Down Gobankingrates

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Portal Irs Warns Of Wrong Amounts Here S What You Should Do Gobankingrates

The Advance Child Tax Credit What Lies Ahead

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What To Do If You Still Haven T Received Your Child Tax Credit Payment Forbes Advisor

Missing A Child Tax Credit Payment Here S How To Track It Cnet