waterbury ct tax assessor

The Assessor does not provide property tax information. You also have the option to pay your property and real estate taxes in person at the Tax Collectors Office 235 Grand Street 1st floor.

Municipal Officials Worry About Lamont S Proposed Cap On Car Taxes

415543594360352 latitude -730434799194336 longitude.

. Tax Assessors Office provides information on the assessment and value of real estate motor vehicles business property and personal property. The purpose of the Assessors office is to discover list and value all real estate business personal property and motor vehicles in a uniform equitable manner conforming to State and Federal standards and mandates. View Cart Checkout.

Assessors Office 1 Municipal Drive Canterbury CT 06331 Email. All Tax Maps have ROWs and Easements. City of Waterbury Connecticut Property Assessment Map City of Waterbury Assessors Department 1 inch 50 feet This map is for informational purposes only and has not been prepared for or suitable for legal engineering or surveying purposes.

Government Websites by CivicPlus. 155 Deer Hill Avenue. Appraisal Experience Our Company assures that the fair and equitable assessment of properties is achieved our staff members which have the highest level of mass appraisal skills.

Notice of Board of Assessment Appealspdf. Home Shopping Cart Checkout. Click here for directions to City Hall.

View Full Size Map 1-5 MB Assessor Tax Map 003. City Of Waterbury CT. Original Mylar Tax Map.

2016 CT ECO Aerial Photograph. The established tax base provides for approximately one-half of the total Town budget. More details about Waterbury Tax Assessors Office.

Included in the Grand List are real estate business personal property and registered motor vehicles. Elderly Homeowner Blank Applpdf. 155 Deer Hill Avenue.

Revenue Bill Search Pay - City Of Waterbury CT. The Assessors office is responsible for the maintenance of records on the ownership of properties. Courtyard Level Waterbury CT 6702 Get Directions.

Aerial Photograph GIS Tax Map 002. Working with the Valuation supervisor the Assessor can customize the data to be gathered and the cost tables to meet their specific needs. If not there is an interest charge of 15 per month 18 annually from the due date with a minimum interest charge of 200 per bill.

Board of Assessment Appeals Applicationpdf. Waterbury Tax Assessors Office is categorized under Public Finance Activities. Address 235 Grand Street.

GIS based Assessors Tax Map overlaying the. Account info last updated on Aug 6 2022 0 Bills - 000 Total. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

Government Websites by CivicPlus. Payments in lieu of taxes. The City of Waterbury makes no warranties express or implied as to the use of the information obtained herein.

Assessments are computed at 70 of the estimated market value of real property at the time of the last revaluation which was 2017. Taxes must be paid within a month of the due date. According to our records this business is located at 235 Grand Stin Waterburyin New Haven County Connecticut06702 the location GPS coordinates are.

You can call the City of Waterbury Tax Assessors Office for assistance at 203-574-6821. In doing this we ensure that every property owner is. The Property Search Assessor and Permit information updated nightly The maps and data obtained from this site are for informational purposes only all information is subject to verification.

Original Mylar Tax Map. Tax Bills are mailed in Late June for October 1st Grand List and Late December for Supplemental Grand List installment due dates of July 1st and January 1st. Scanned Copy of the Assessors Mylar Tax Map.

Users of this information should review or consult the. Please call the assessors office in Waterbury before you send documents or if you need to schedule a meeting. The Assessors Office has the responsibility of assessing every taxable and exempt property located in the City of Danbury and compiling these assessments into the Citys Grand List.

How To Win A Ct Property Tax Assessment Appeal Idoni

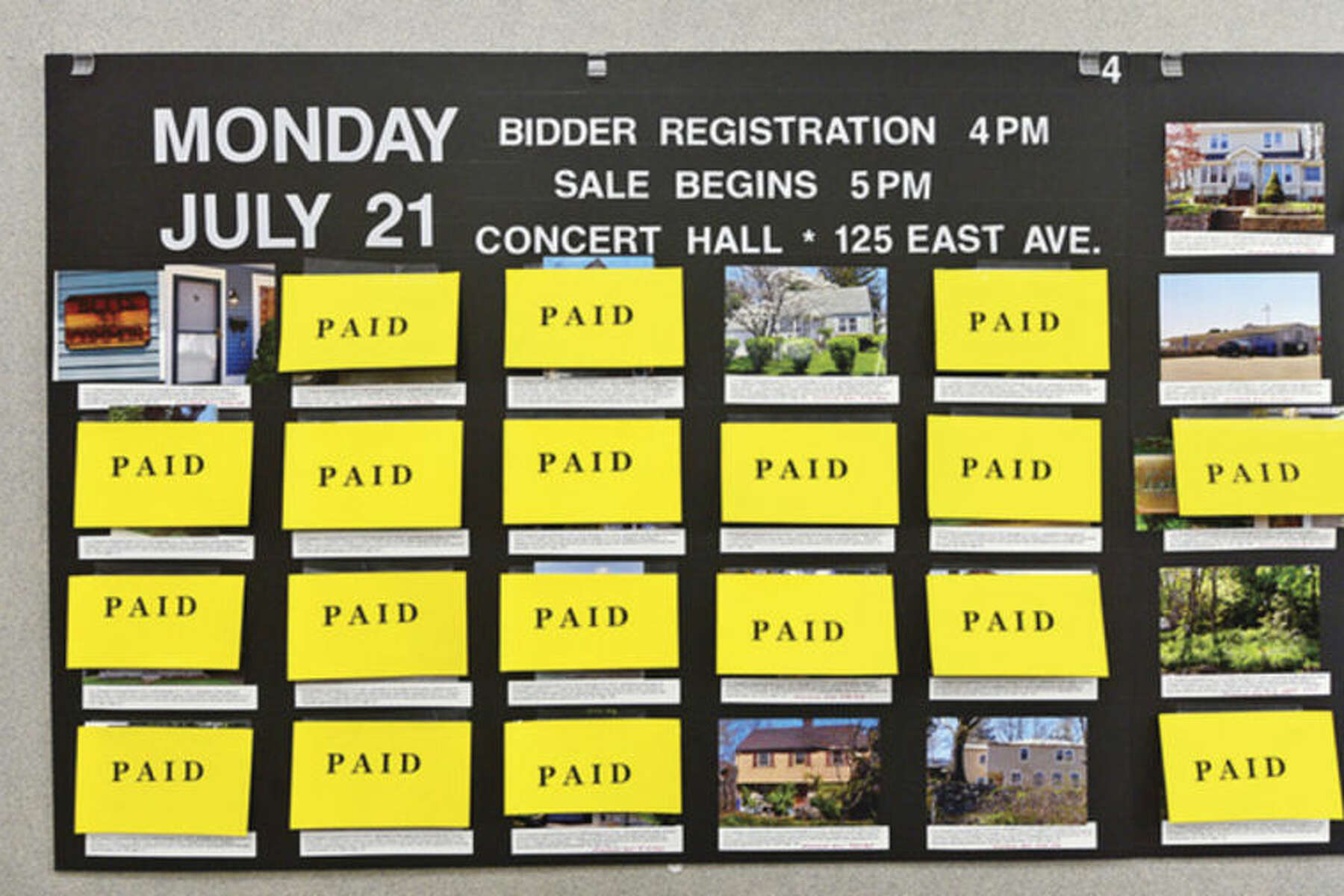

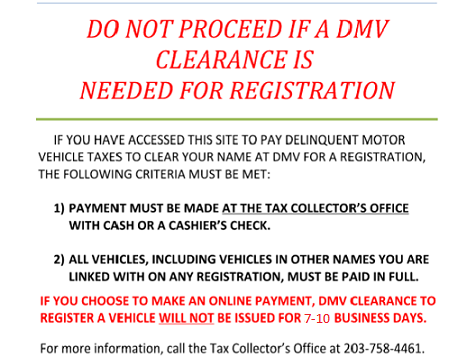

Delinquent Tax Collector State Marshals Work Together To Collect Back Taxes

Connecticut Property Tax Calculator Smartasset

Hartford S Exorbitant Commercial Property Tax Curbs Economic Growth

Meriden Non Profits Challenge City Tax Assessments In Court

Town Of Prospect Tax Bills Search Pay

House Adopts One Of The Largest Tax Cuts In Connecticut History News Journalinquirer Com

How To Win A Ct Property Tax Assessment Appeal Idoni

Property Taxes By State Quicken Loans

Klr Am I Responsible For A Deceased Loved One S Unpaid Tax Bills

10 States With The Lowest Property Taxes In 2022

110 S State Road 19 Palatka Fl 32177 Property Record

Municipal Officials Worry About Lamont S Proposed Cap On Car Taxes